Harness AI to build an efficient, smarter, and more comprehensive ESG service line for your Consulting Firm

EASGeniusAI enables Consulting Firms to scale ESG delivery, generate strategic insights, and reduce resource intensity across the full ESG lifecycle, supporting teams in delivering higher value ESG advisory outcomes.

EASGeniusAI supports Consulting Firms delivering ESG services across multiple clients, sectors, frameworks/ standards and geographies. By automating time intensive and intelligent analysis, the platform reduces delivery friction while strengthening the quality, credibility and auditability of deliverables.

Consulting Firms can license EASGeniusAI as part of their delivery toolkit, applying it across client engagements to streamline ESG assessments, disclosures, benchmarking, and reporting.

Book a free discovery discussion with our team

Our team will contact you to schedule a discussion tailored to your organisation’s ESG priorities and challenges.

We use your information to contact you about your discussion request and relevant updates. Learn more in our Privacy Notice.

EASGeniusAI in Action for Consulting Firms

From initial client assessment through to final reporting and peer comparison, EASGeniusAI supports the full ESG consulting delivery lifecycle. For Consulting Firms, this means faster turnaround, greater repeatability, and stronger internal quality control across engagements.

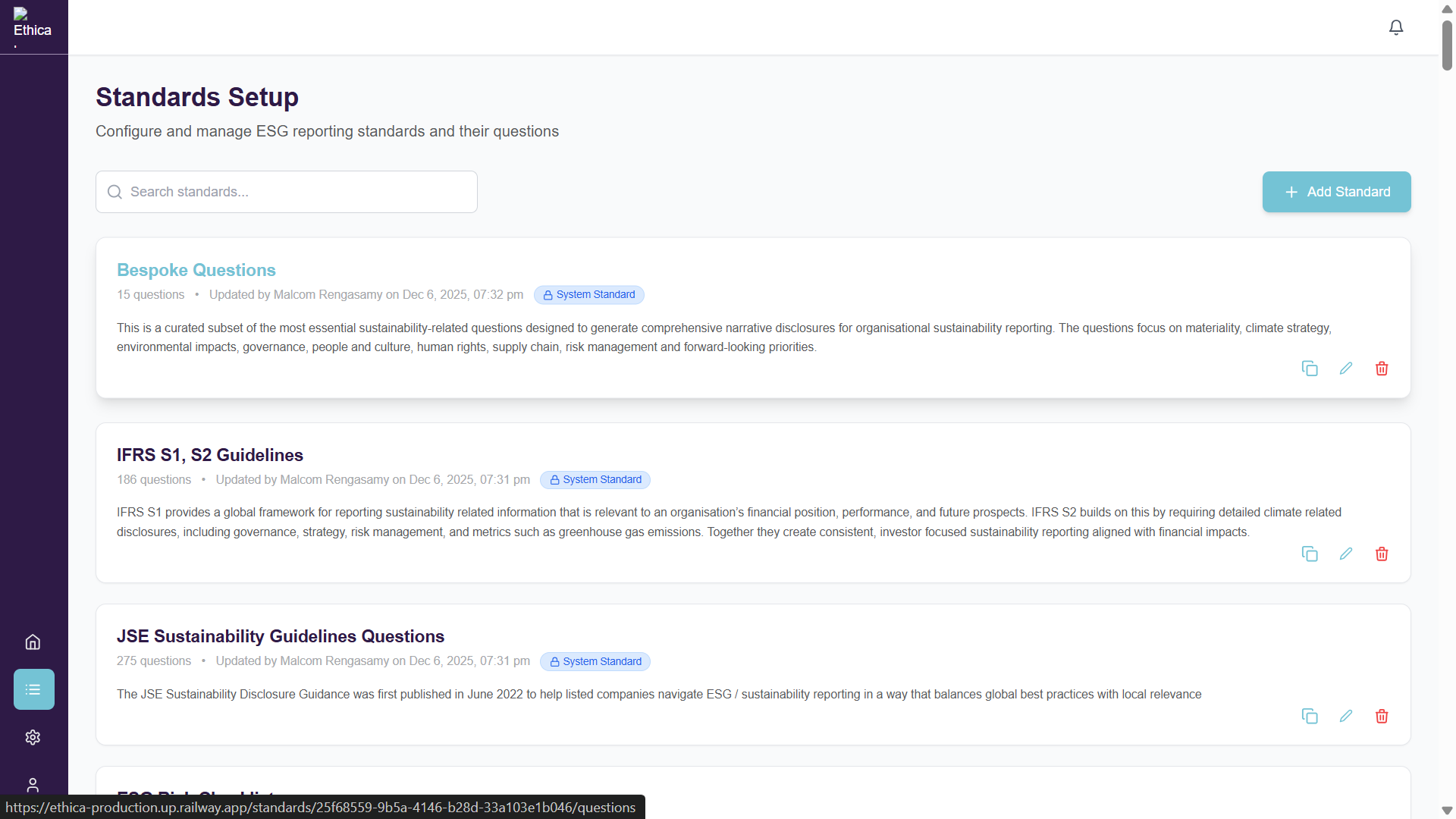

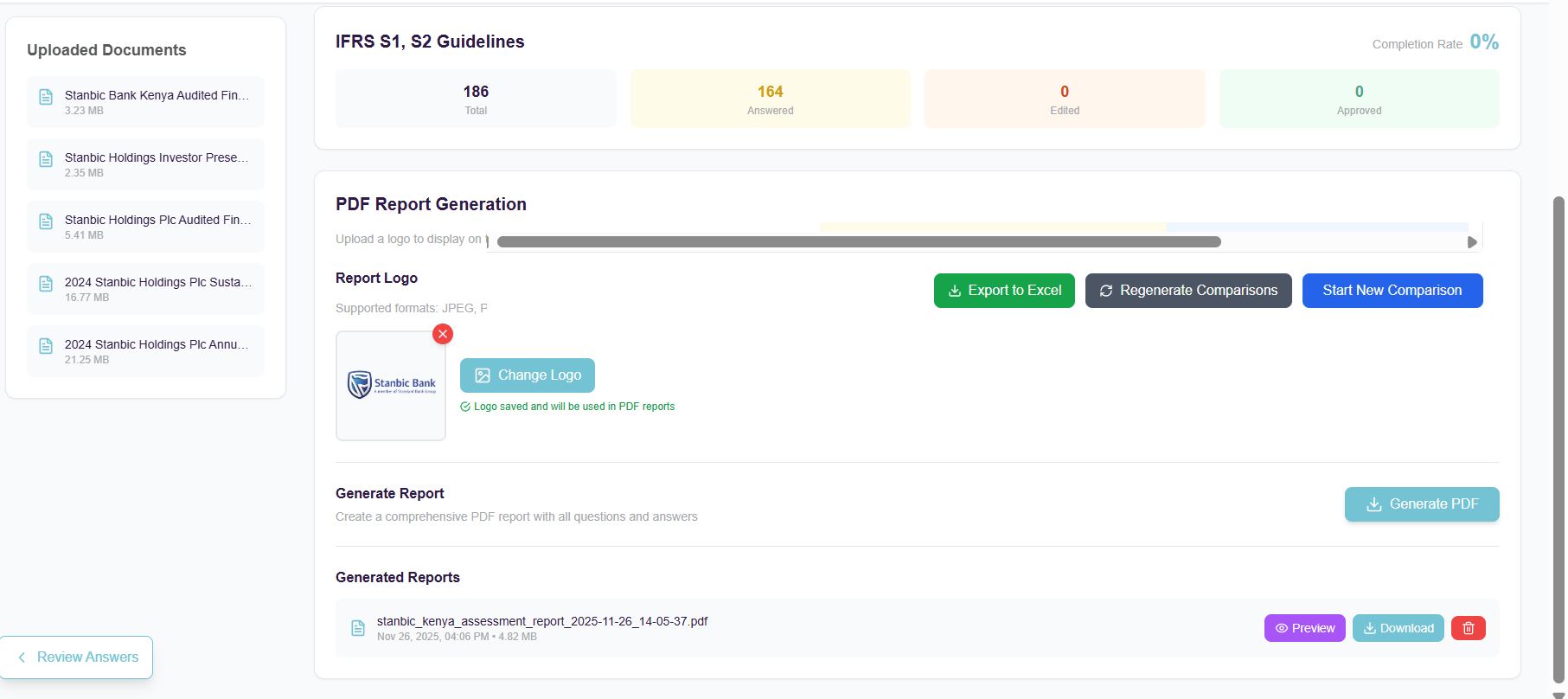

Define standards

Start with IFRS S1, IFRS S2, ESRS, GRI, or bespoke client requirements, and structure them into a consistent assessment and reporting framework.

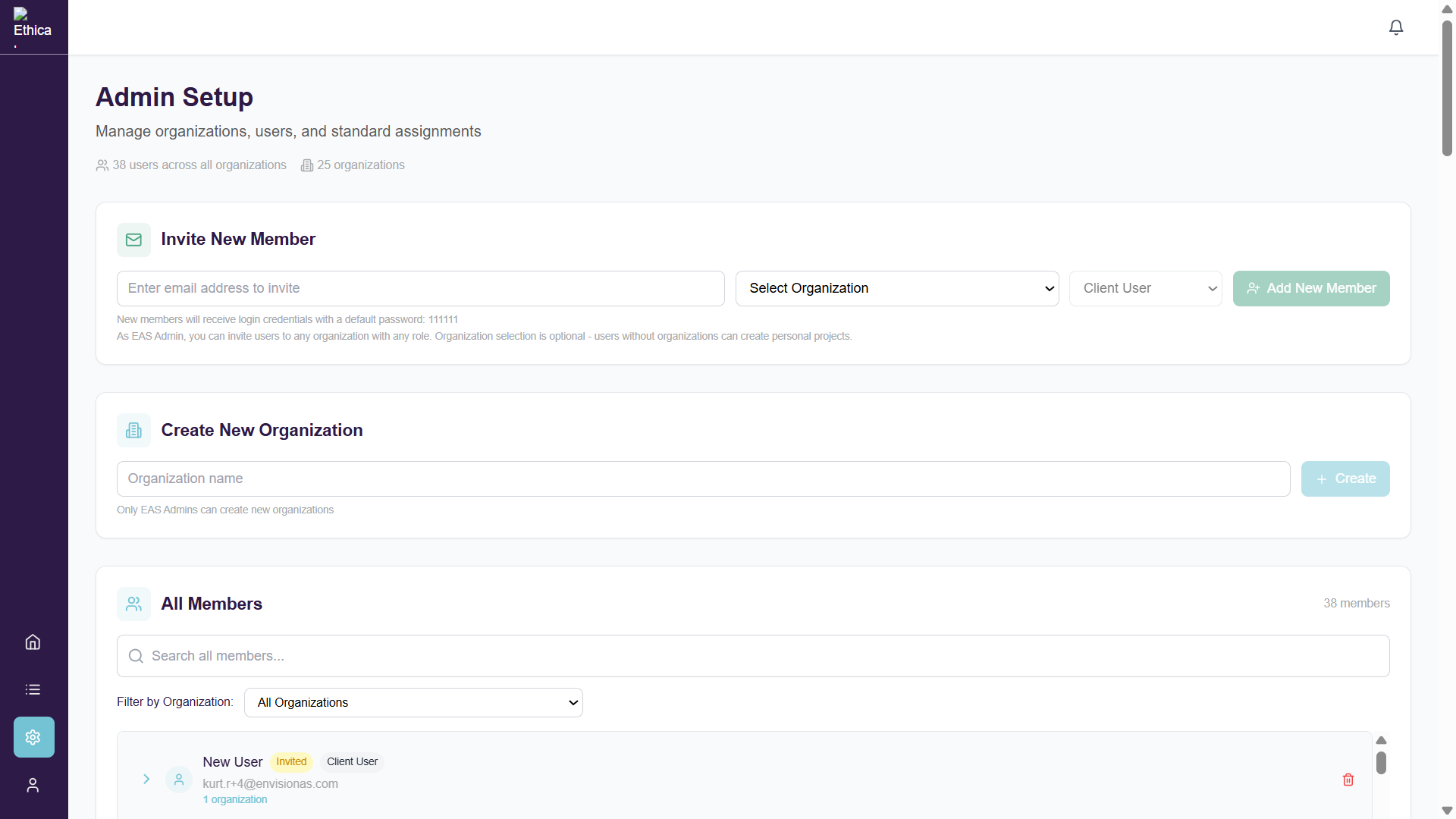

Set up organisations

Create client workspaces, add consultantteam members, and assign permissions so responsibilities, review, and approvals are clearly defined.

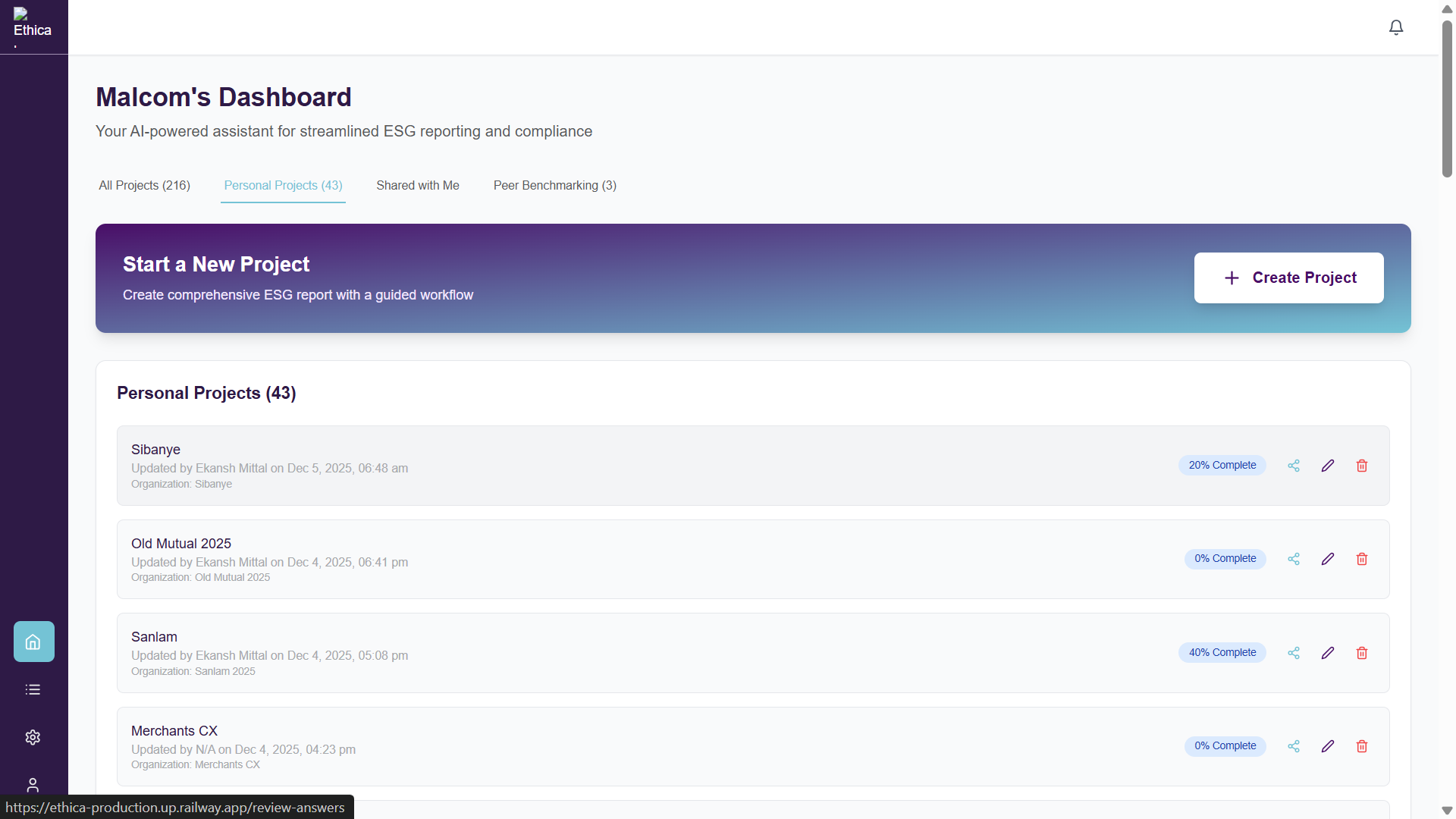

Create ESG projects

Set up projects for disclosures, lender questionnaires, assurance readiness, or internal client reviews in a structured and repeatable environment.

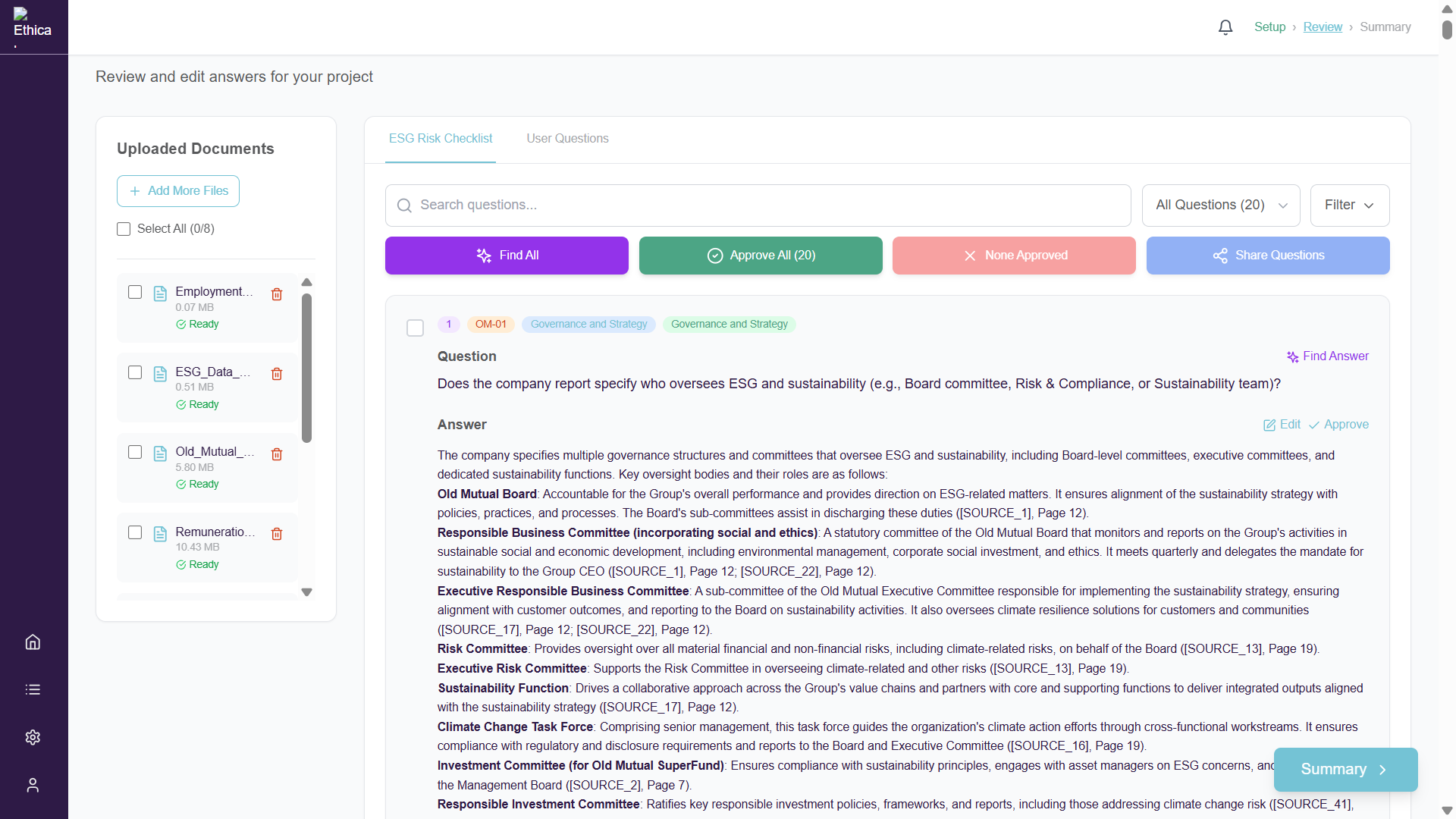

AI responses

Upload policies, reports, data files, and supporting documentation. Generate structured responses referenced to sources, with consultant led editing and approvals.

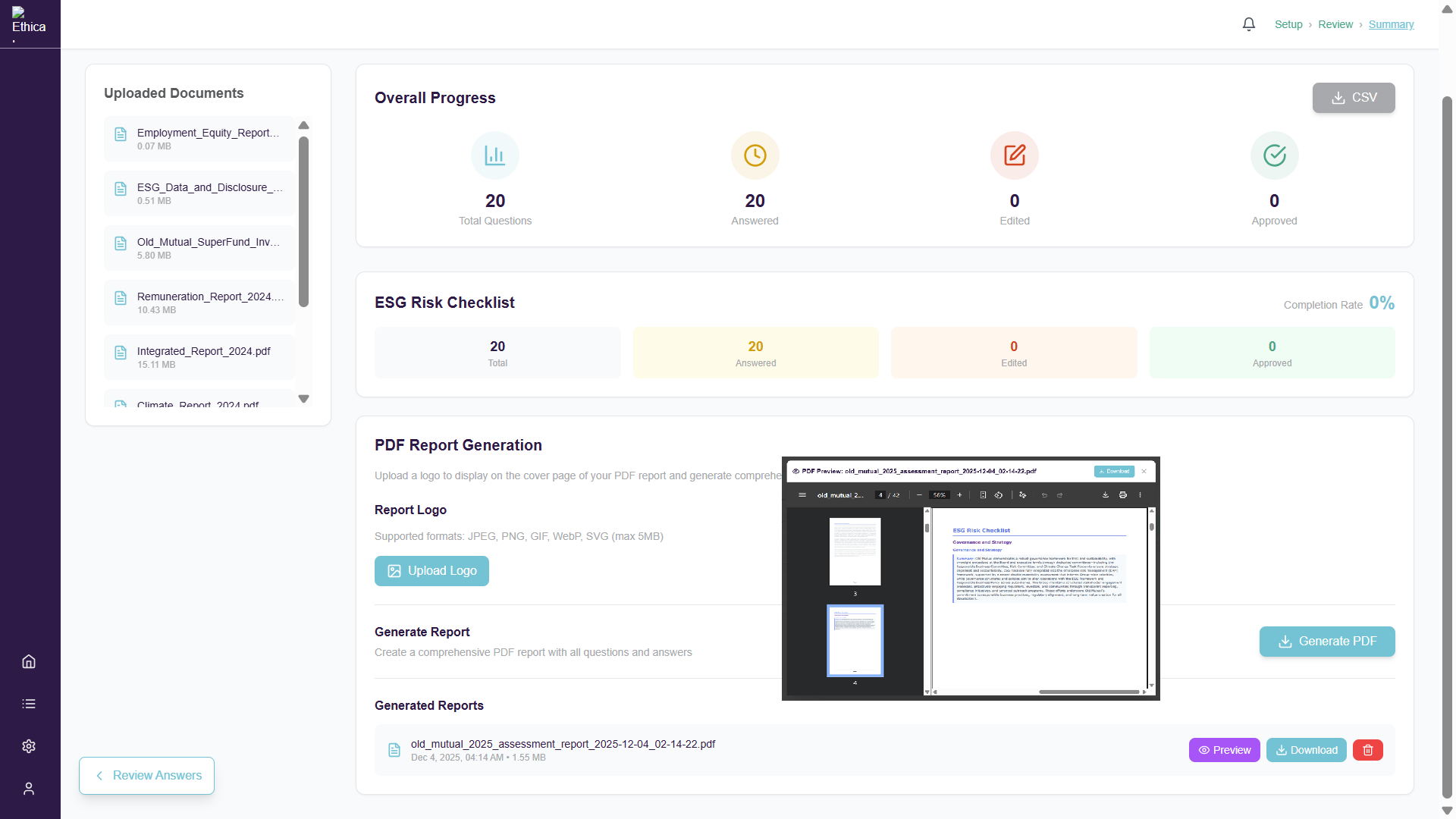

Generate

reports

Produce polished outputs including executive summaries, narrative explanations, and framework aligned disclosures, ready for client review.

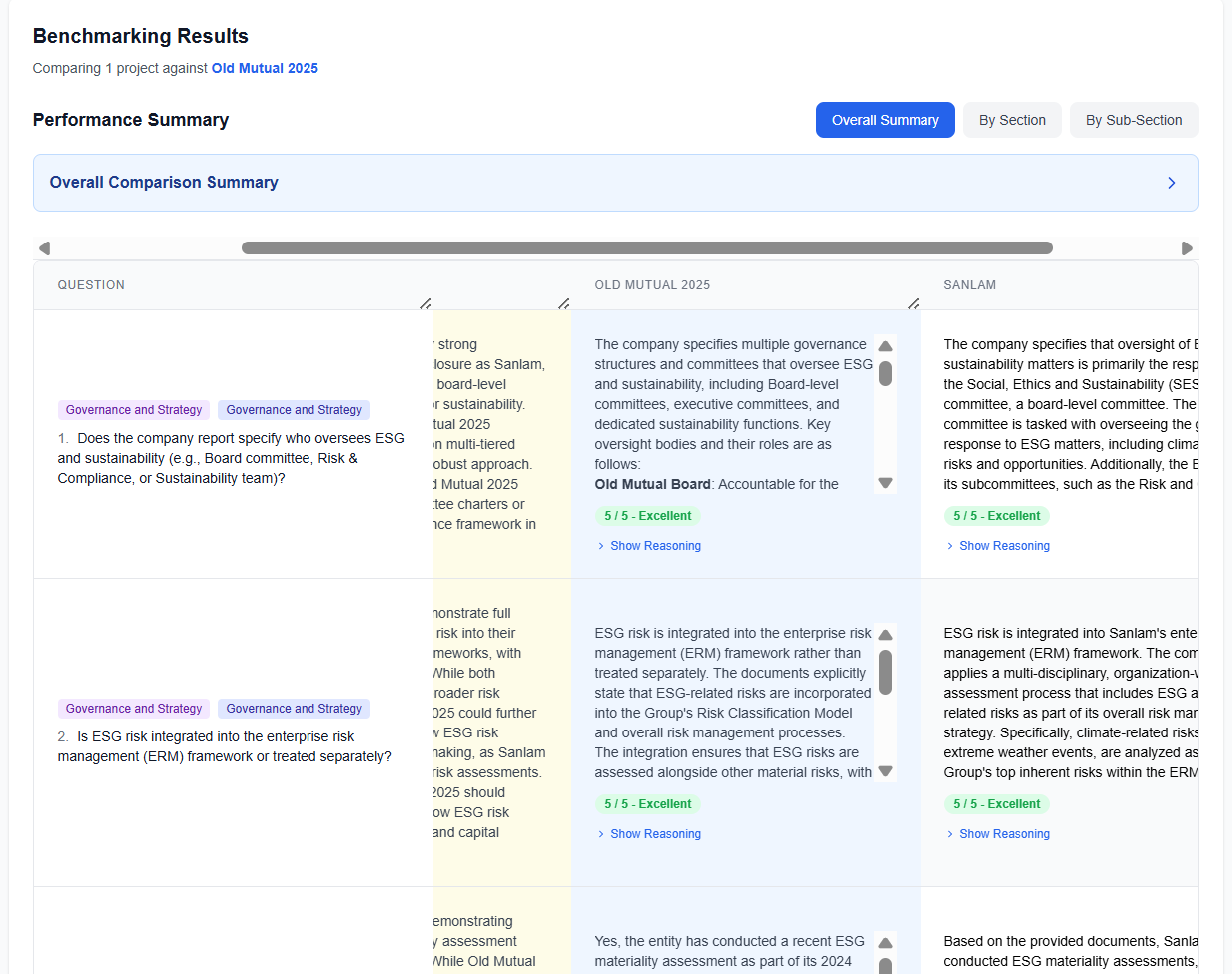

Benchmark clients

against peers

Select peer organisations and apply consistent scoring to identify strengths, gaps, and practical improvement priorities across engagements.

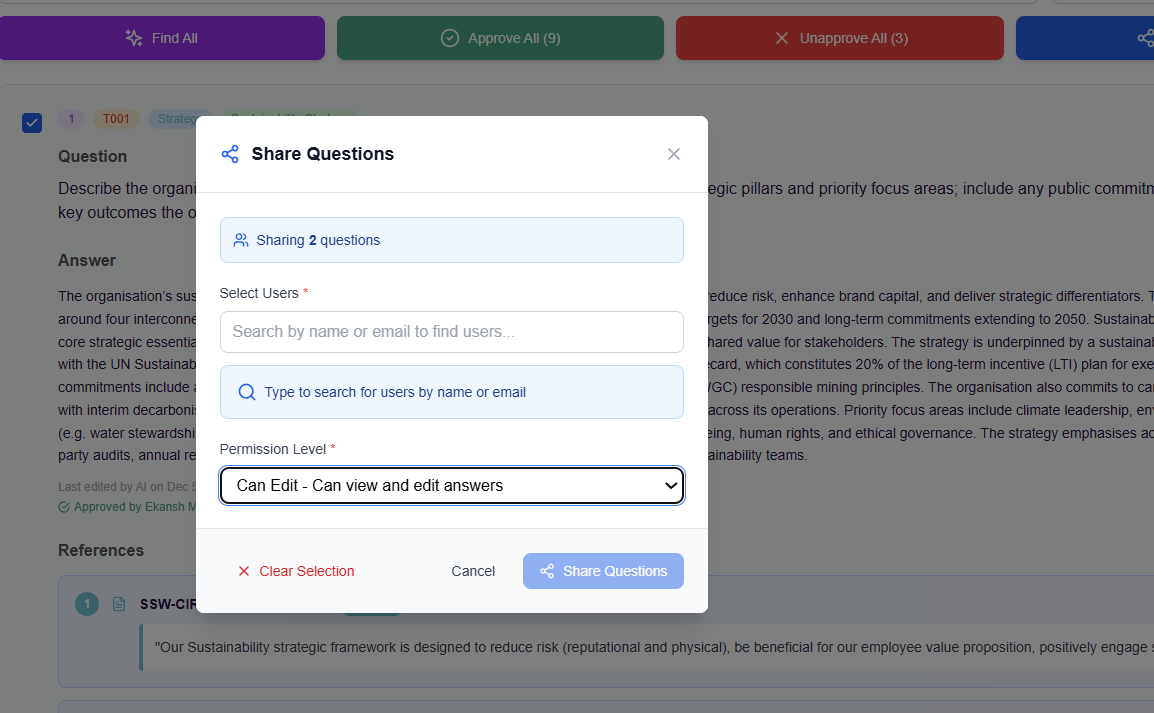

Manage workflow, tasks

and collaboration

Control who can draft, review, approve, or view content across client projects, supporting governance and delivery oversight.

Export structured

outputs

Download reports or export structured ESG data to CSV for further analysis, dashboards, or integration into client reporting and design workflows.

Key benefits for Consulting Firms

EASGeniusAI supports Consulting Firms across the full ESG lifecycle, reducing delivery friction while improving repeatability, review control, and standard alignment across client engagements.

Scale ESG services across the client ESG lifecycle

Automate repetitive ESG analysis and disclosure tasks so teams can deliver more client engagements in parallel without compromising quality or overloading consultants.

Improve consistency across engagements

Apply the same logic, structure, and scoring approach across clients, sectors, and frameworks, reducing variability and strengthening quality assurance.

Support multiple frameworks across the ESG lifecycle

Reuse structured ESG information across IFRS, ESRS, GRI, lender questionnaires, and bespoke requirements, avoiding duplication and repetitive manual work.

Free up senior consultants for higher value advisory

Reduce time spent on document review and mechanical tasks across the ESG lifecycle.

Generate lifecycle wide, strategic ESG insight for clients

Support clients across the full ESG lifecycle, from baseline assessments and disclosure readiness through to benchmarking, improvement planning, and ongoing monitoring. EASGeniusAI transforms dispersed ESG information into clear insight on strengths, weaknesses, risks, opportunities, and gaps, enabling consultants to deliver defensible recommendations that align ESG priorities with business strategy and long term objectives.

Purpose built for ESG delivery within Consulting Firms

License the platform, embed it into your ESG delivery methodology, and support consistent, scalable outcomes across multiple client engagements.

How Consulting Firms use EASGeniusAI in practice

Consulting Firms license EASGeniusAI and apply it across multiple client engagements as a core component of ESG delivery.

Typical use cases include ESG baseline and gap assessments, IFRS S1 and S2 disclosures (amongst other frameworks), lender and investor questionnaires, peer benchmarking and scoring exercises, and multi year ESG tracking programmes.

The platform also supports strategic ESG exercises such as intelligent SWOT analysis and identification of material risks and opportunities, while keeping efficiency, traceability, and auditability at the forefront.

Typical use cases include ESG baseline and gap assessments, IFRS S1 and S2 disclosures (amongst other frameworks), lender and investor questionnaires, peer benchmarking and scoring exercises, and multi year ESG tracking programmes.

The platform also supports strategic ESG exercises such as intelligent SWOT analysis and identification of material risks and opportunities, while keeping efficiency, traceability, and auditability at the forefront.

Commercial model alignment

EASGeniusAI is designed to align with consulting business models and delivery economics.

Firms can license the platform for internal use, apply it across multiple client engagements, embed it directly into their ESG delivery methodology, and scale ESG services without linear increases in delivery effort.

This enables margin protection, controlled service expansion, and more predictable ESG delivery outcomes.

Firms can license the platform for internal use, apply it across multiple client engagements, embed it directly into their ESG delivery methodology, and scale ESG services without linear increases in delivery effort.

This enables margin protection, controlled service expansion, and more predictable ESG delivery outcomes.

How this positions Consulting Firms

More efficient and scalable advisors

Consistent and methodical across the full ESG lifecycle

Stronger on traceability and audit readiness

Forward looking in the use of technology

This strengthens credibility with clients seeking ESG advice that is both rigorous and commercially practical.

Consistent and methodical across the full ESG lifecycle

Stronger on traceability and audit readiness

Forward looking in the use of technology

This strengthens credibility with clients seeking ESG advice that is both rigorous and commercially practical.