Utilise AI to Strengthen Strategic and Operational Insights Across AM and PE Portfolios

EASGeniusAI supports Asset Managers and Private Equity firms across the full ESG investment lifecycle, enabling consistent ESG insight, earlier risk identification, and more informed engagement across portfolios.

Designed for investment teams managing diverse holdings, EASGeniusAI brings structure, comparability, intelligence and insight to ESG across portfolio companies, supporting better due-diligence, analysis, benchmarking, scoring, decision making & stewardship.

EASGeniusAI enables AM and PE teams to move beyond fragmented disclosures toward decision-useful strategic insights embedded within portfolio management and stewardship processes.

Book a free discovery discussion with our team

Our team will contact you to schedule a discussion tailored to your organisation’s ESG priorities and challenges.

We use your information to contact you about your discussion request and relevant updates. Learn more in our Privacy Notice.

EASGeniusAI in Action for Asset Managers and Private Equity

From ESG assessment and due diligence through to portfolio level benchmarking, monitoring, and engagement, EASGeniusAI supports ESG integration across the full investment lifecycle for AM and PE firms.

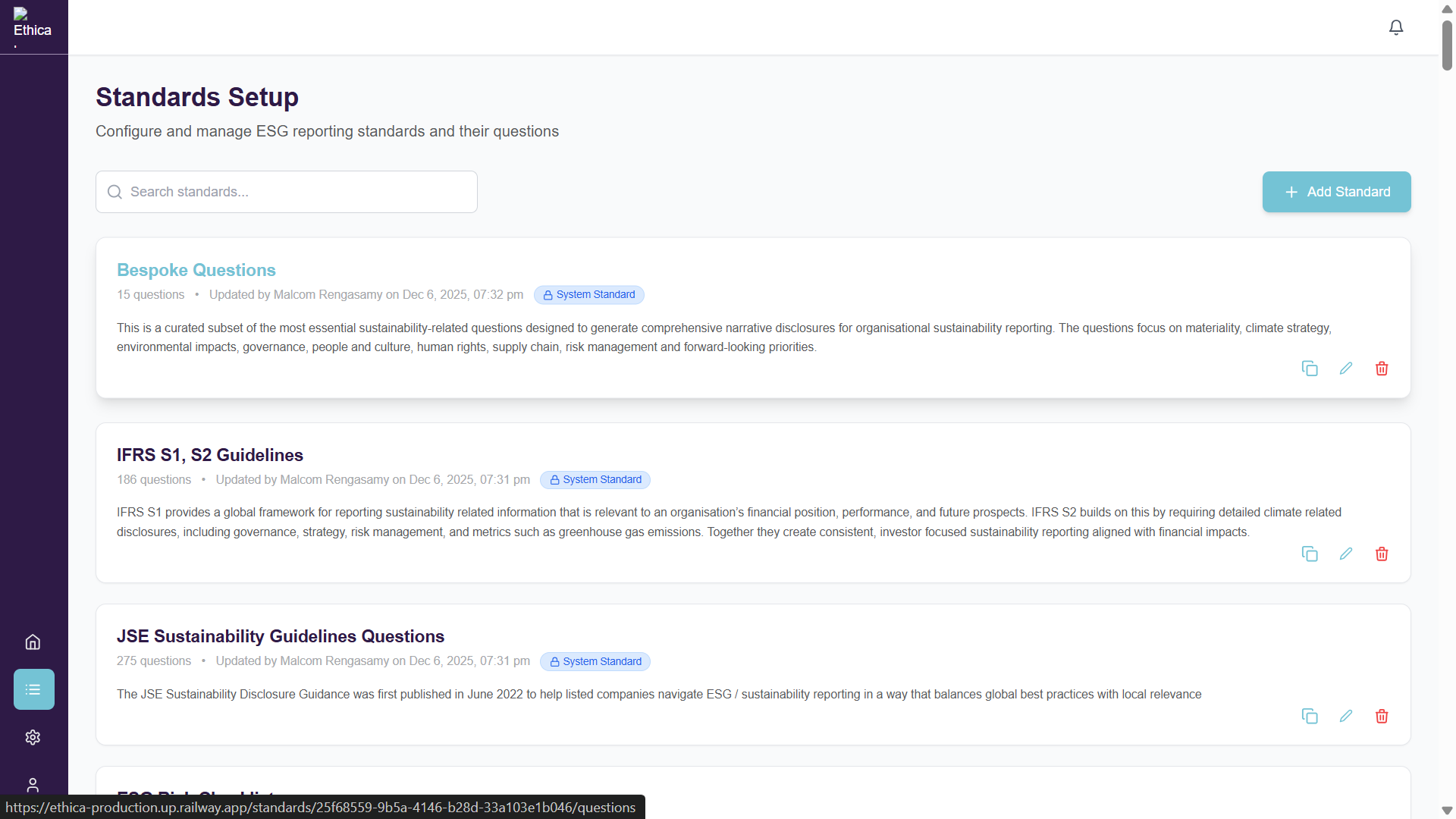

Define ESG frameworks

and criteria

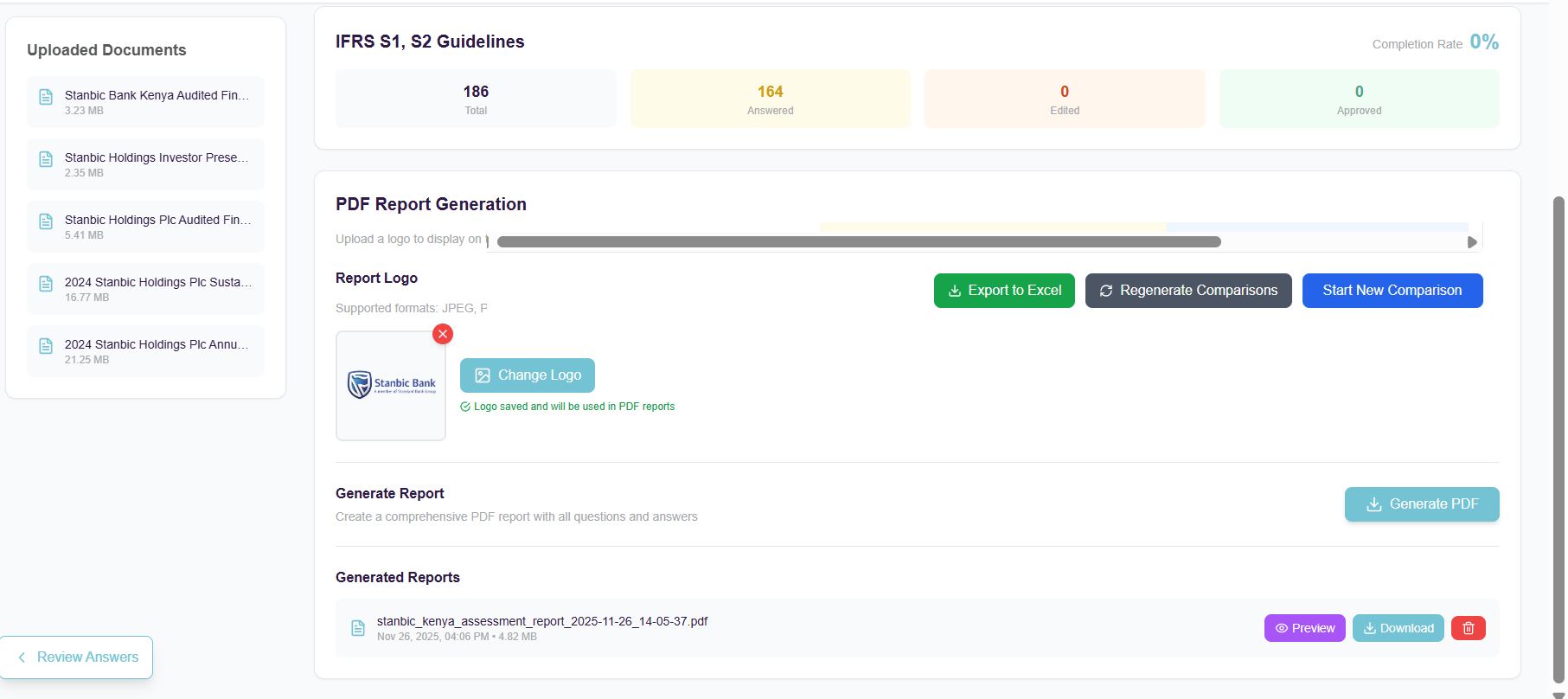

Select relevant frameworks and criteria, including IFRS S1, IFRS S2, proprietary methodologies, due-diligence criteria, and fund-specific requirements.

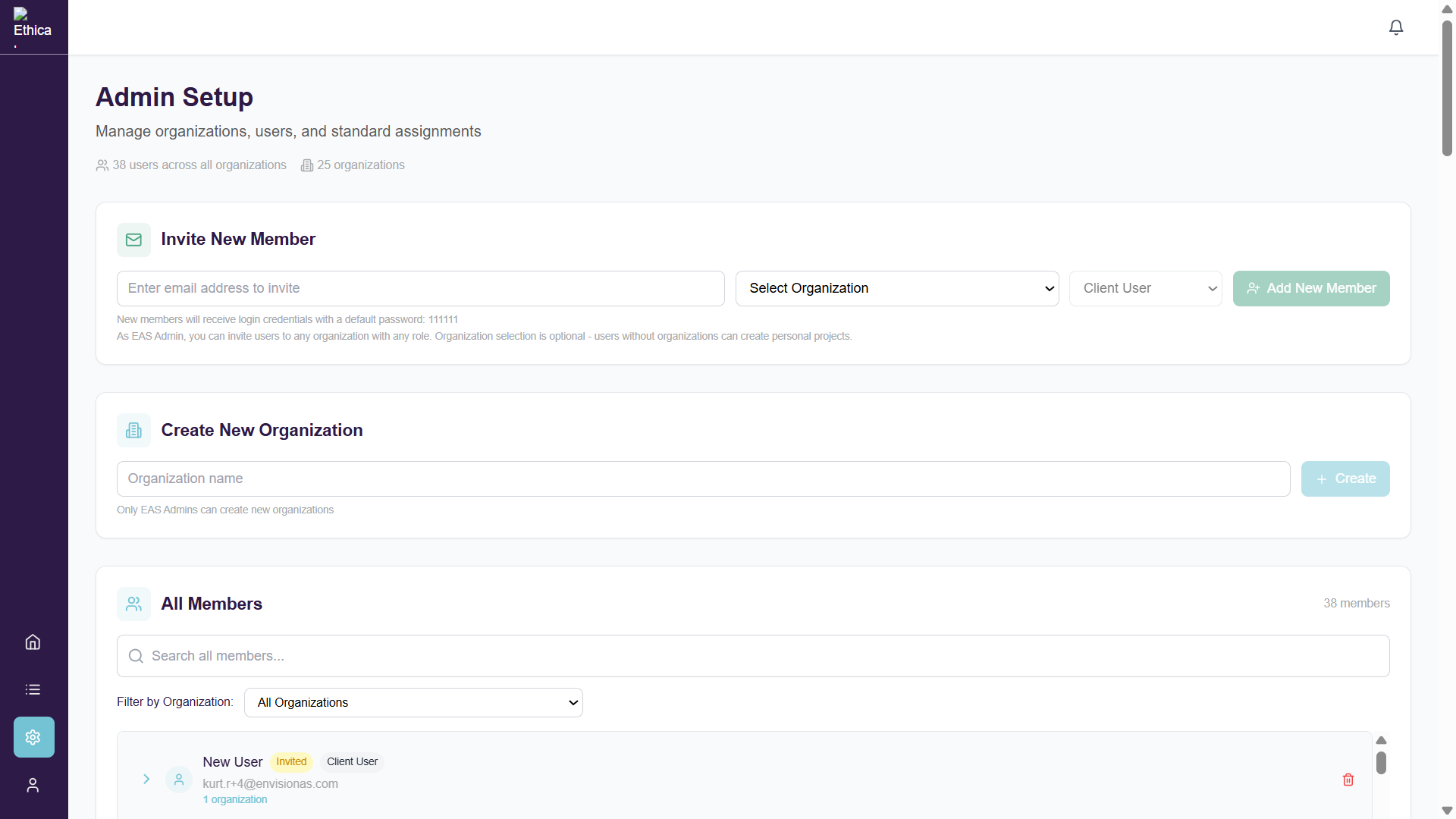

Structure portfolios,

and funds

Organise portfolios by fund, sector, geography, or asset class and map holdings to enable consistent ESG assessment and comparison.

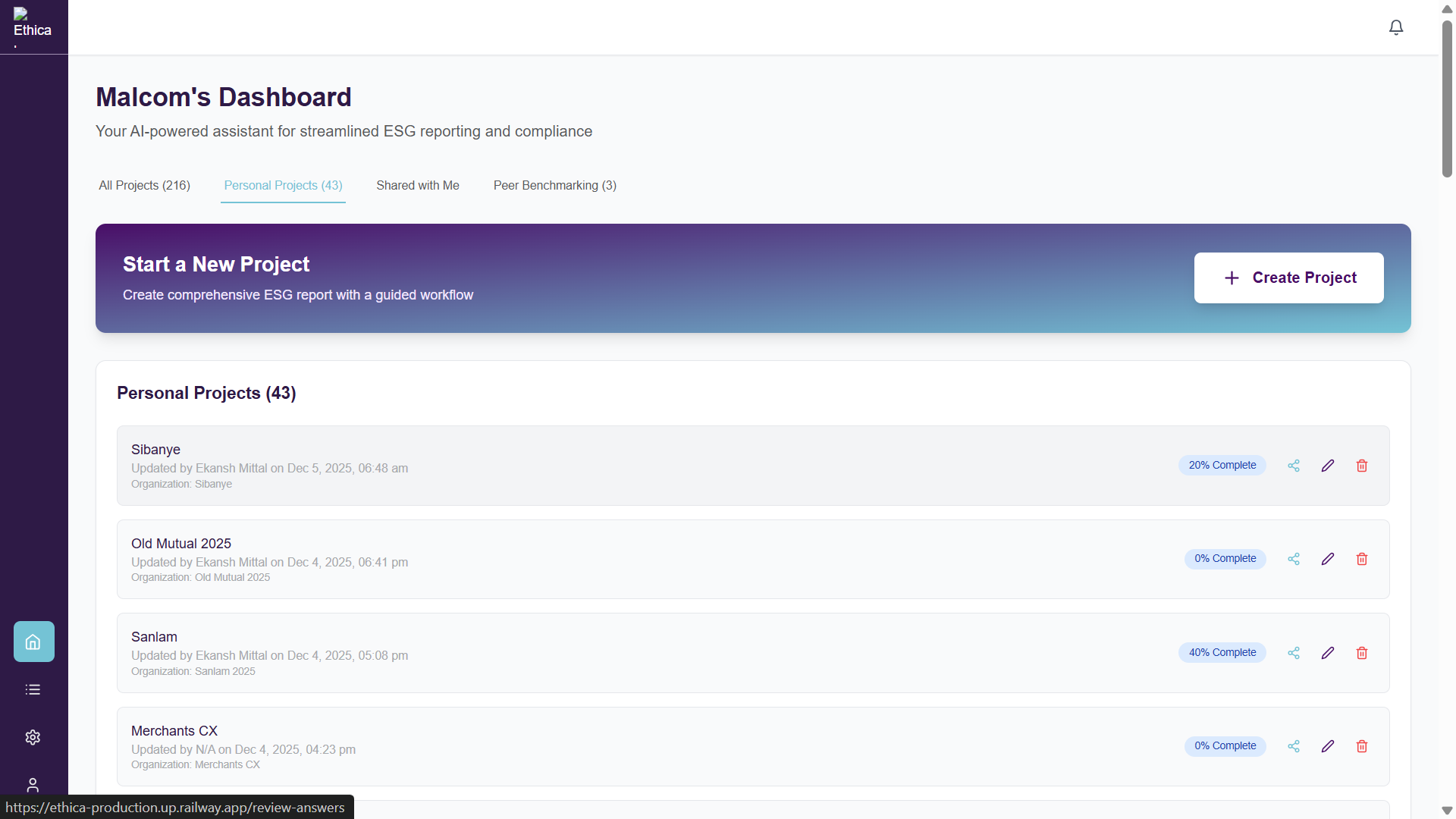

Create ESG review

projects

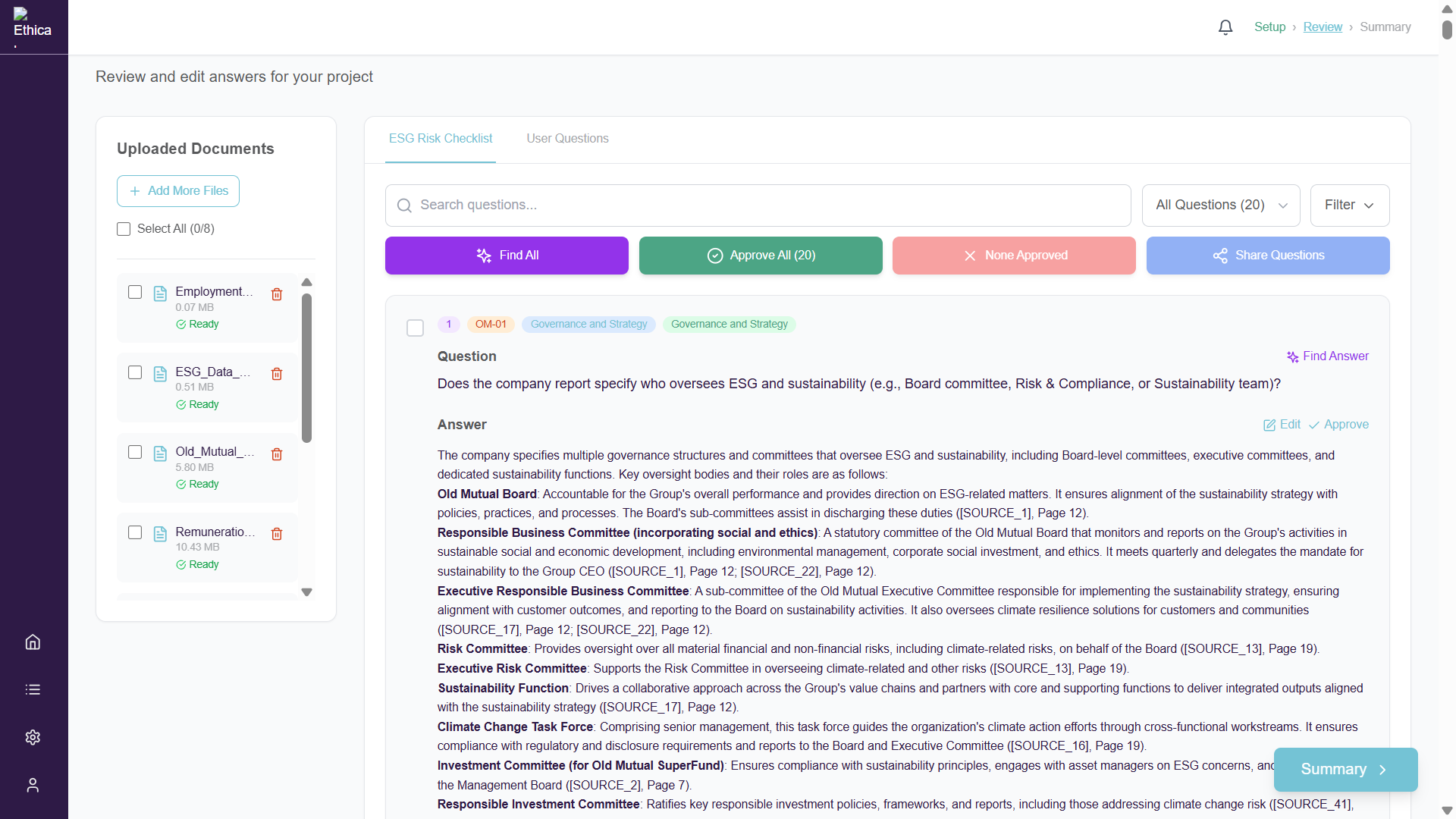

Set up structured projects for due diligence, annual reviews, stewardship cycles, internal ESG assessments, or thematic ESG analysis.

Upload disclosures

and evidence

Upload sustainability reports, annual reports, due-diligence questionnaires, policies, and evidence across holdings for structured and traceable analysis.

Generate

ESG insights

Standardise ESG information across issuers, highlighting gaps, weak signals, and emerging ESG risks.

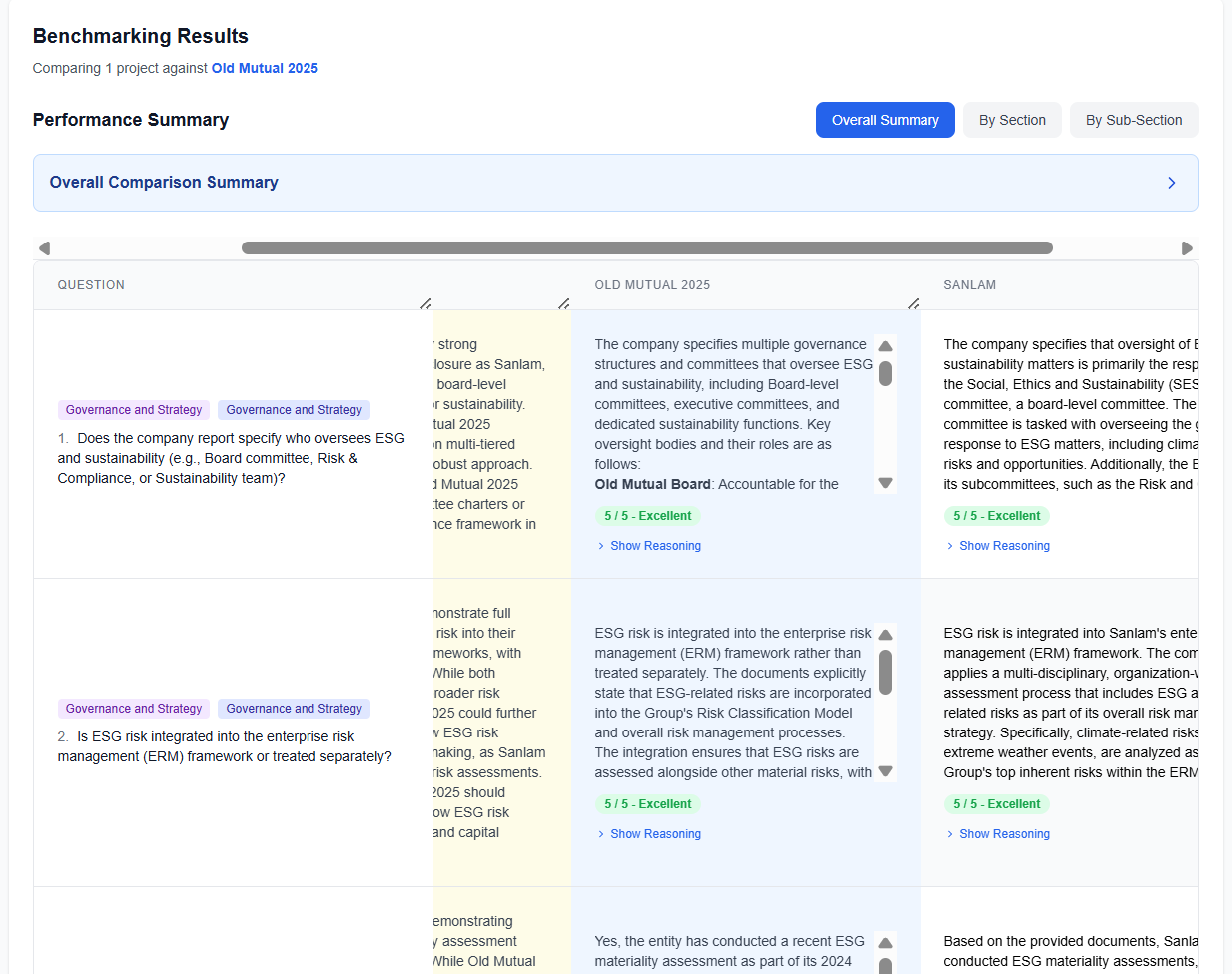

Apply scoring

and benchmarking

Score holdings consistently and benchmark against peer groups to identify leaders, laggards, and engagement priorities.

Identify risks

and priorities

Use scoring and benchmarking to surface ESG risks, material gaps, and priorities for engagement or escalation.

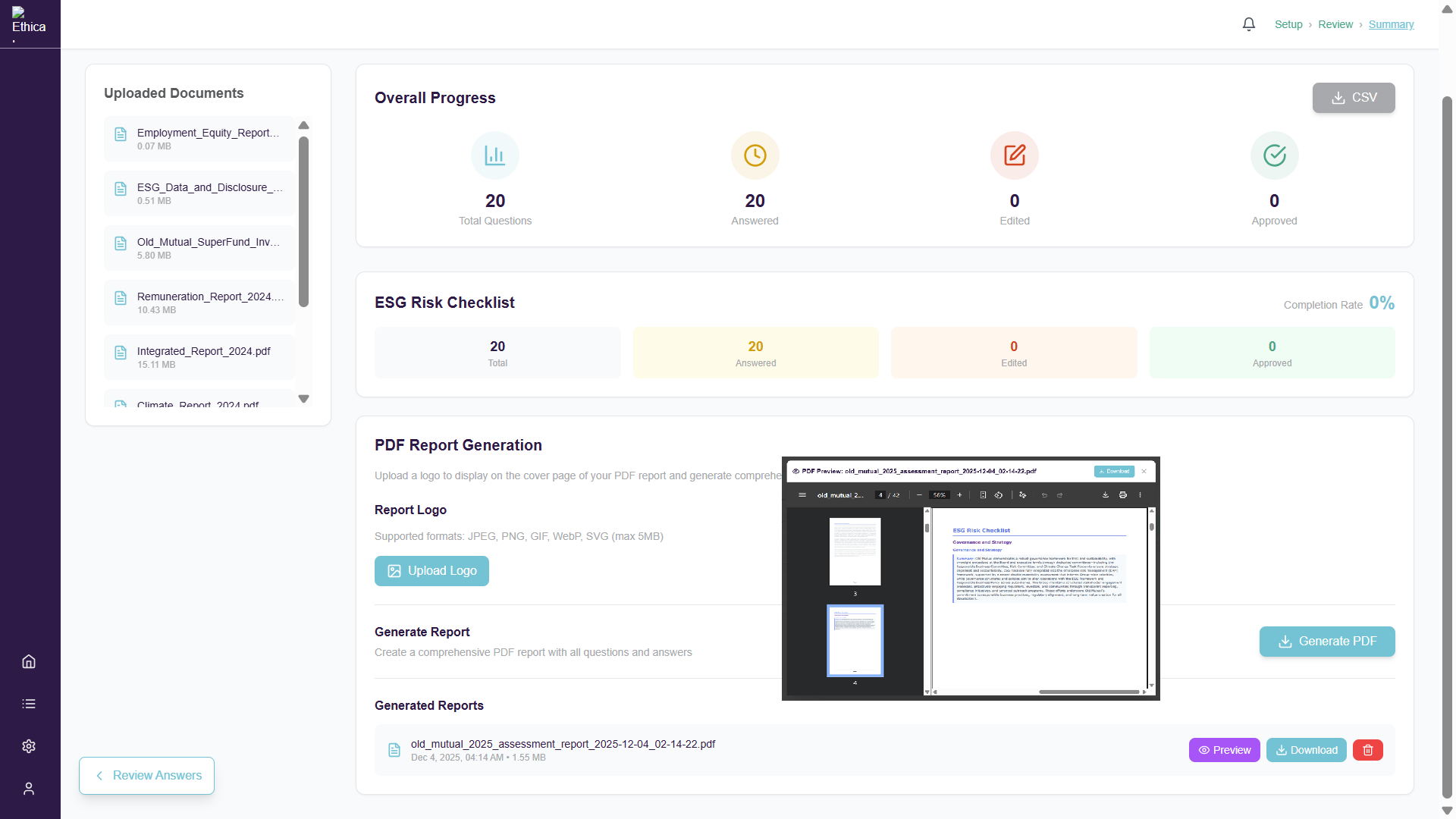

Produce portfolio

decision outputs

Generate structured outputs for investment committees, risk processes, client reporting, and stewardship activities.

Key Benefits for Asset Managers and Private Equity Firms

EASGeniusAI strengthens ESG integration by combining structured analysis, strategic insight, and operational efficiency across portfolios.

Generate strategic ESG insights across portfolios

Translates ESG information into clear insights on strengths, weaknesses, risks, opportunities, and gaps, supporting investment decisions, risk management, and stewardship.

Improve comparability across portfolio companies

Standardise ESG information across issuers with varying disclosure formats and maturity to enable consistent portfolio level analysis.

Reduce manual ESG analysis and review effort

Automate document review, structuring, and scoring to reduce reliance on spreadsheets and ad-hoc processes across investment teams.

Strengthen ESG risk identification and monitoring

Identify weak disclosures, emerging risk signals, and material gaps earlier through consistent scoring and peer benchmarking.

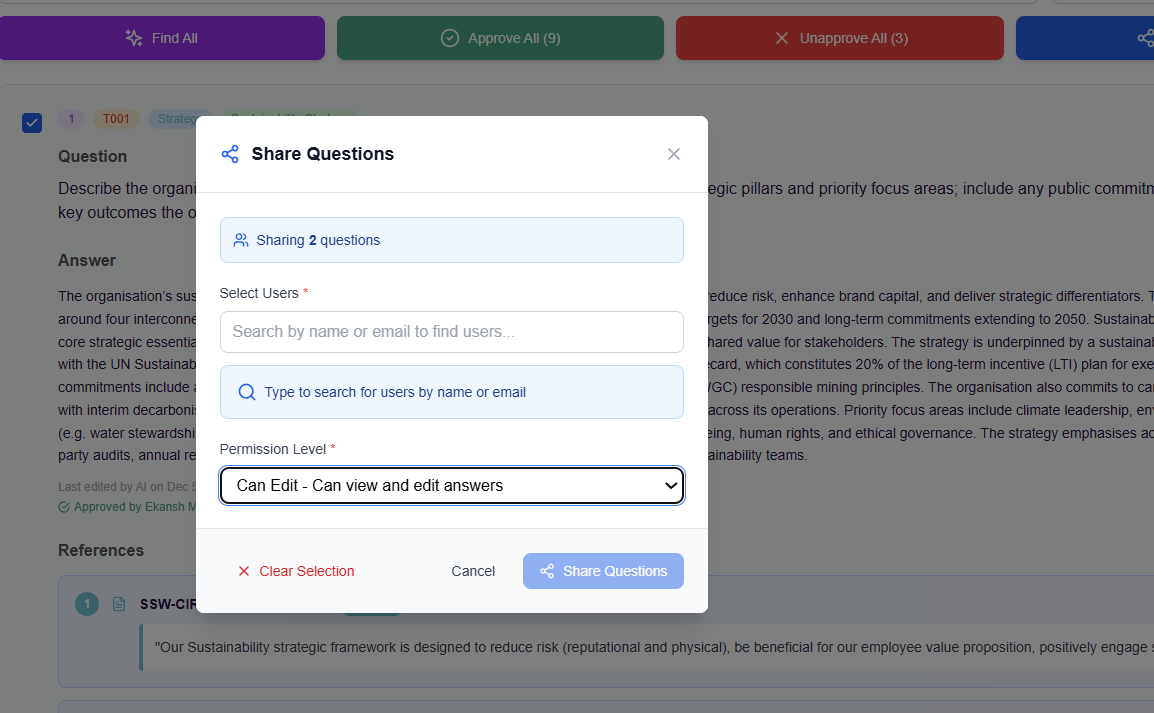

Support credible engagement and stewardship

Engage portfolio companies with evidence based insights supported by structured analysis, benchmarking, and traceable outputs.

Built to Deliver Deeper ESG Analysis and Strategic Insight for AM and PE

Apply consistent ESG scoring and peer benchmarking across holdings, and produce structured outputs for investment and stewardship decisions.

Review and Engagement

Apply consistent ESG scoring and peer benchmarking across holdings, and produce structured outputs for investment and stewardship decisions.

Investor Use Cases

Investors and funds use EASGeniusAI to support portfolio wide ESG assessments, due diligence, ongoing monitoring, engagement prioritisation, and internal ESG reporting. The platform supports both initial assessment and ongoing monitoring across investment lifecycles.

benchmarking and scoring

Apply consistent ESG scoring across topics and compare portfolio companies against sector and geography peer groups to identify leaders, laggards, and engagement priorities. Track performance over time to support stewardship, risk management, and clearer portfolio ESG narratives.

strengthen ESG integration

Improve confidence in ESG assessments and comparisons, strengthen engagement and stewardship activities, and integrate ESG more effectively into investment and portfolio management decisions.