Leverage AI to advance ESG in your organisation

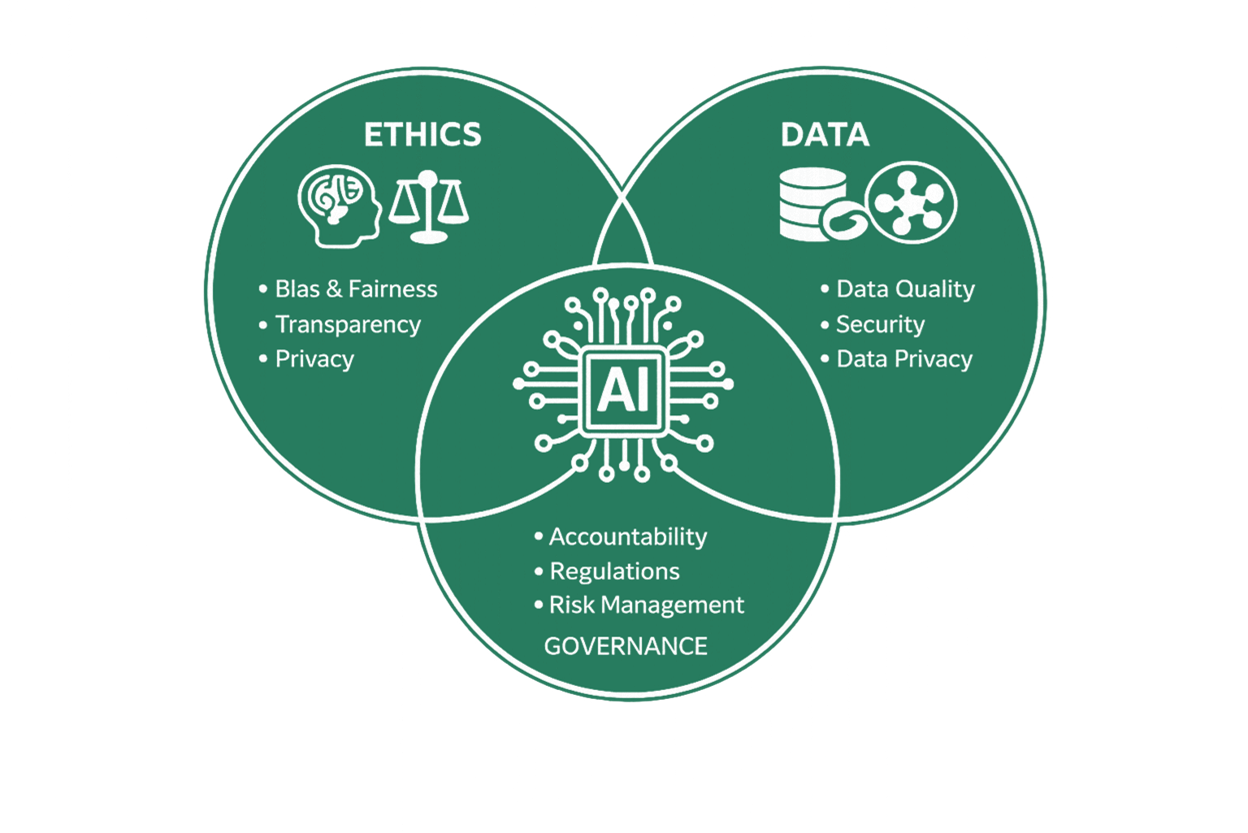

Shaped by ESG specialists and powered by AI, EASGeniusAI supports the full ESG lifecycle, delivering sharper strategic insights into strengths, weaknesses, risks, and opportunities, intelligent comparability, stronger traceability, enhanced auditability, and optimised efficiency.

Book a free discovery session with our team to discuss how EASGeniusAI can solve and support ESG across your organisation.

Book a free discovery discussion with our team

Our team will contact you to schedule a discussion tailored to your organisation’s ESG priorities and challenges.

We use your information to contact you about your discussion request and relevant updates. Learn more in our Privacy Notice.

See EASGeniusAI in Action

EASGeniusAI enables organisations to move from fragmented ESG activities to coordinated, insight driven ESG management, supporting informed strategies, decisions, governance, and assurance across the ESG lifecycle.

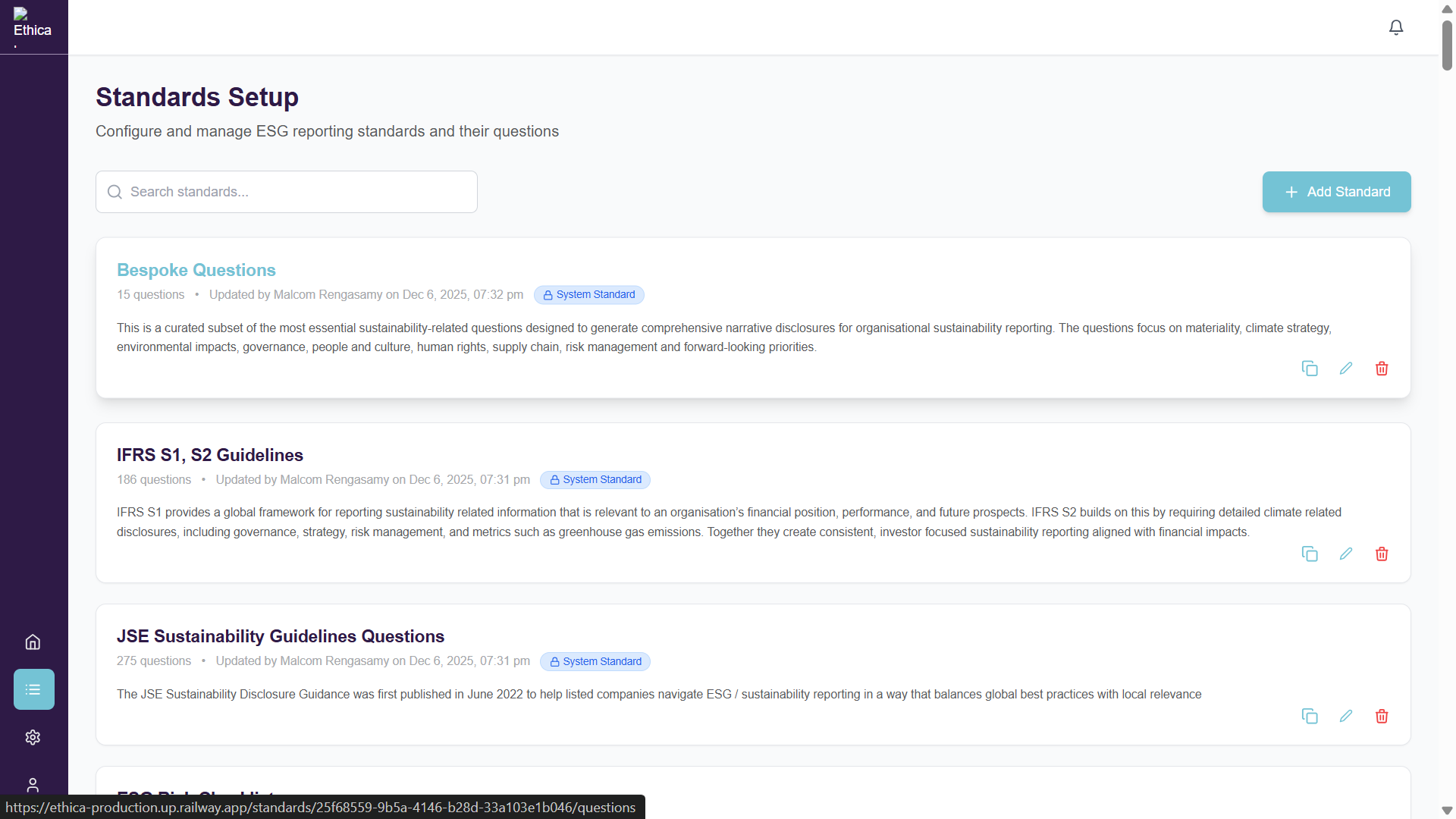

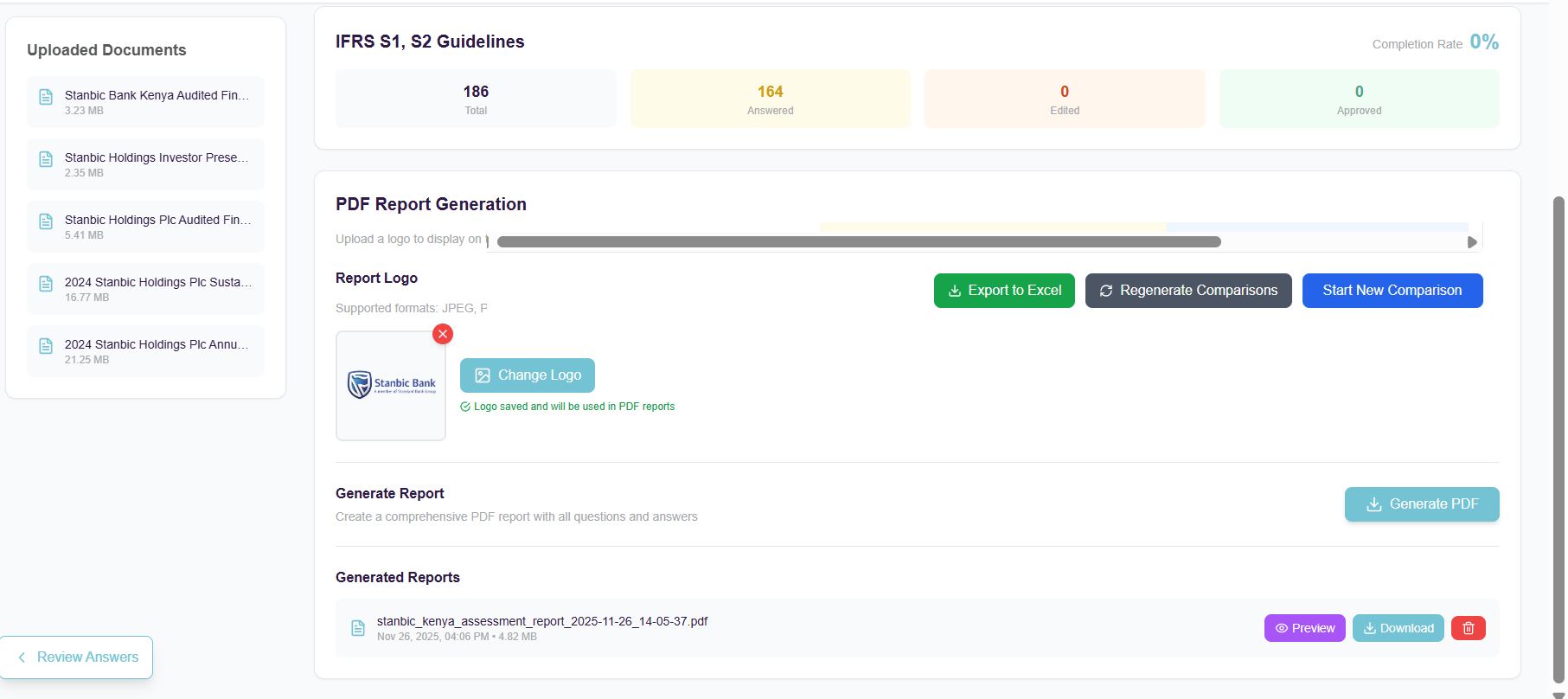

Define your ESG standard and question set

Start with your standard or question list, whether bespoke or aligned to IFRS S1, IFRS S2, ESRS or other frameworks.

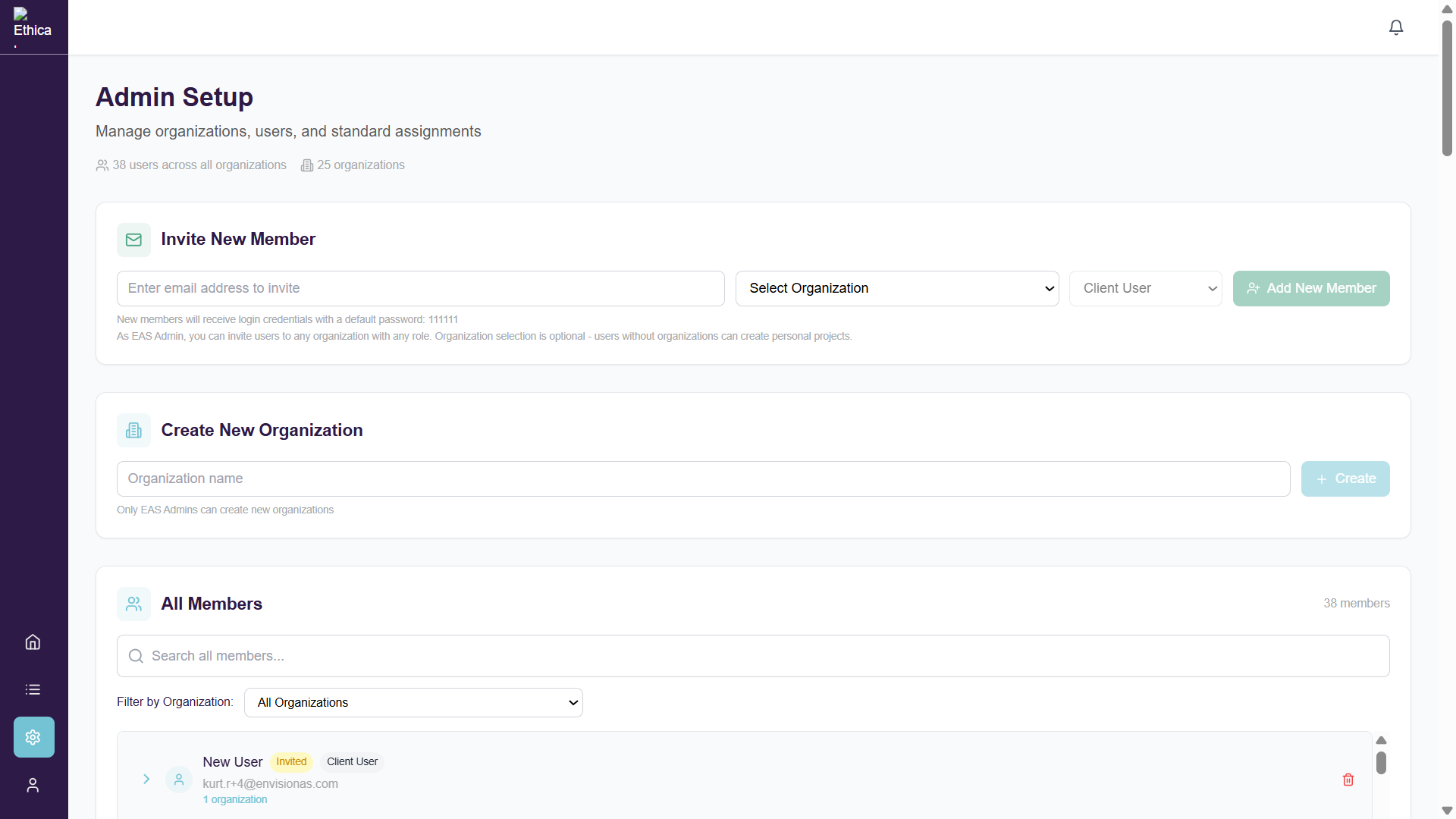

Set up your organisation and team

Add your organisation and team members. Assign permissions and responsibilities so every project has clear ownership and controlled access.

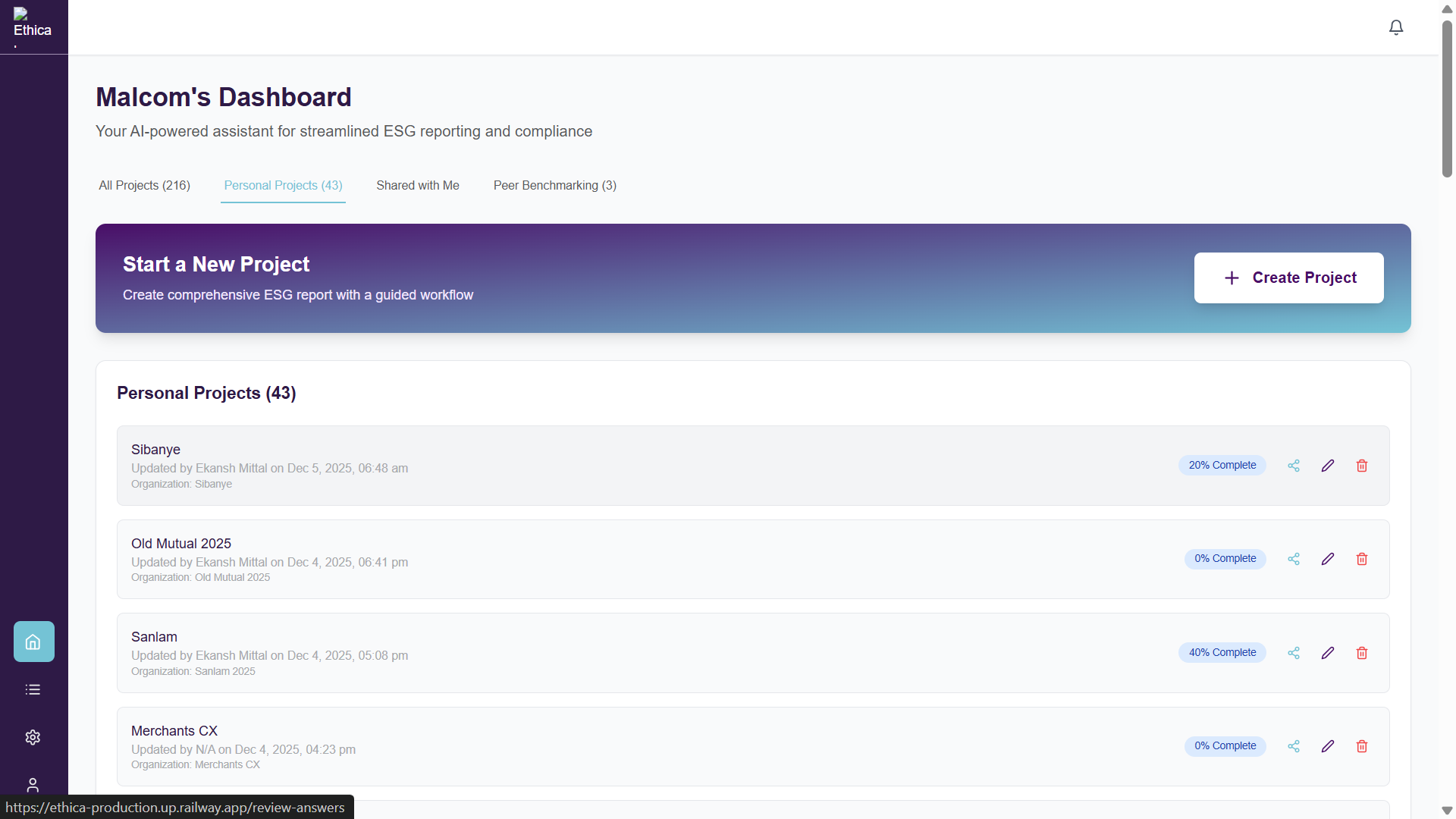

Create your ESG

project

Create your ESG project for a reporting cycle, assurance process, lender questionnaire or internal review in one structured workspace.

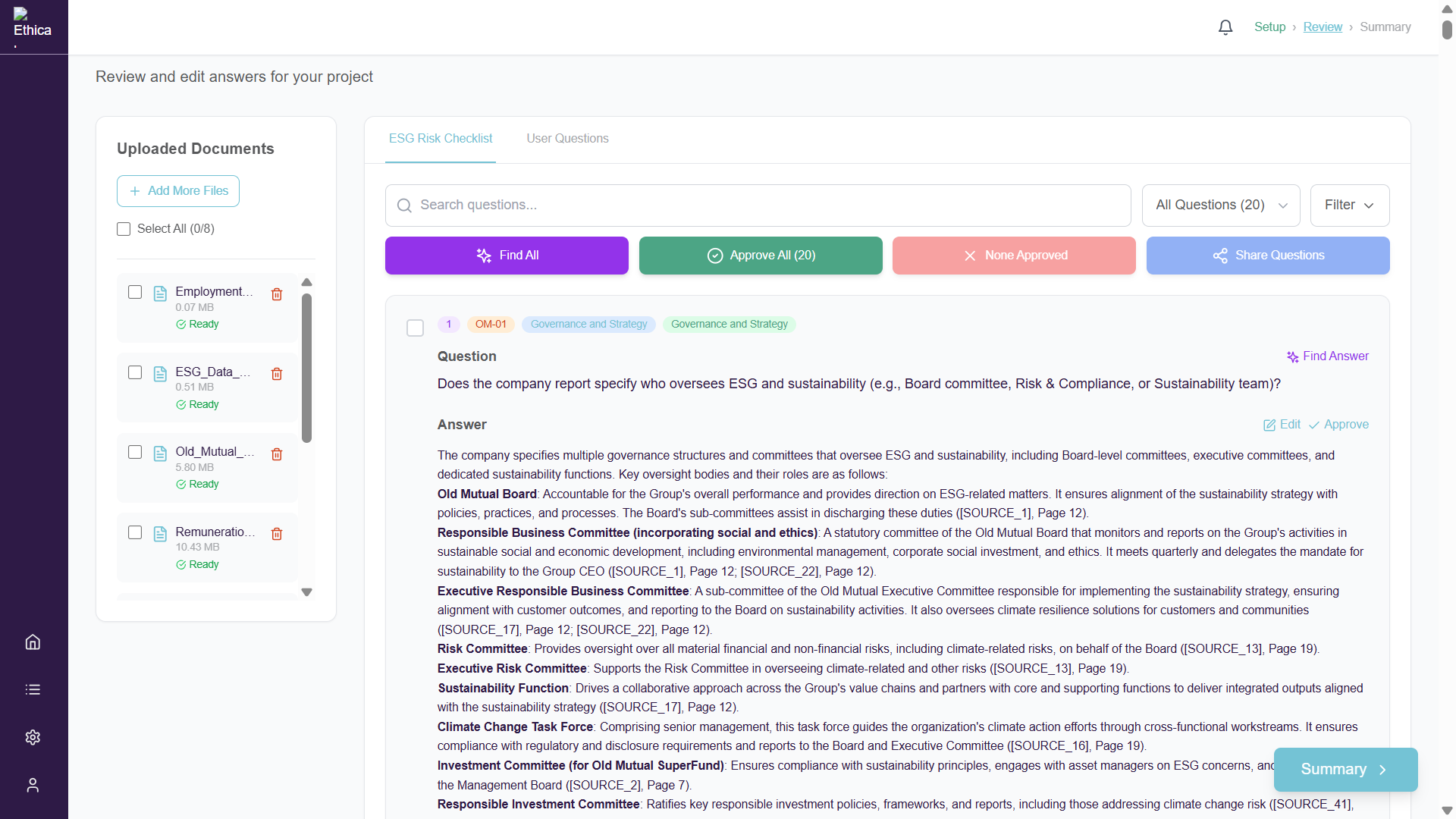

Upload documents and generate AI responses

Upload reports, policies and data files, and generate AI driven responses automatically referenced to your uploaded sources, with editing and approval functionality where required.

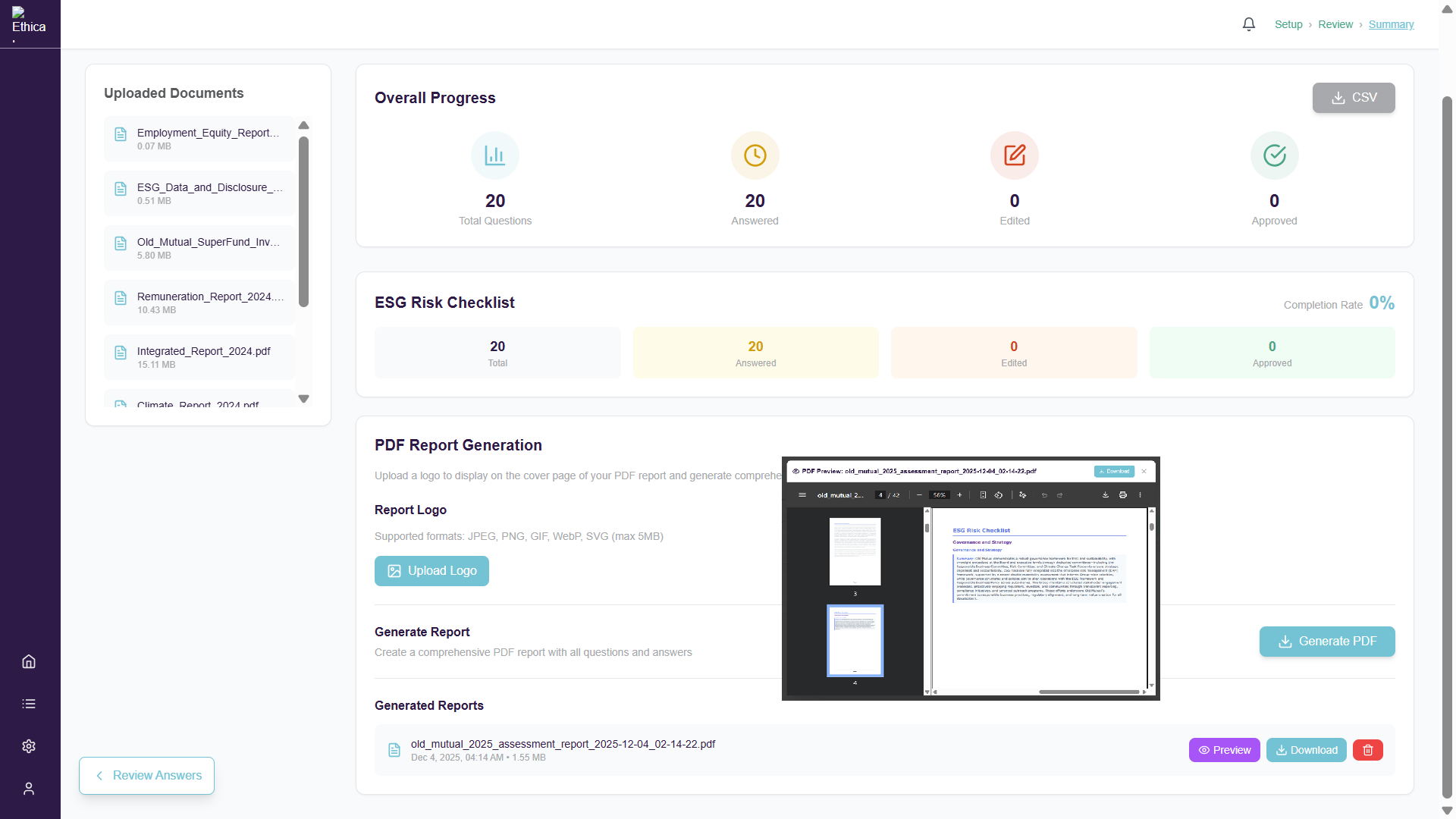

Generate AI powered

ESG reports

Produce polished reports including executive summaries, narrative explanations and framework alignment, or download your question and answer set in an editable CSV format.

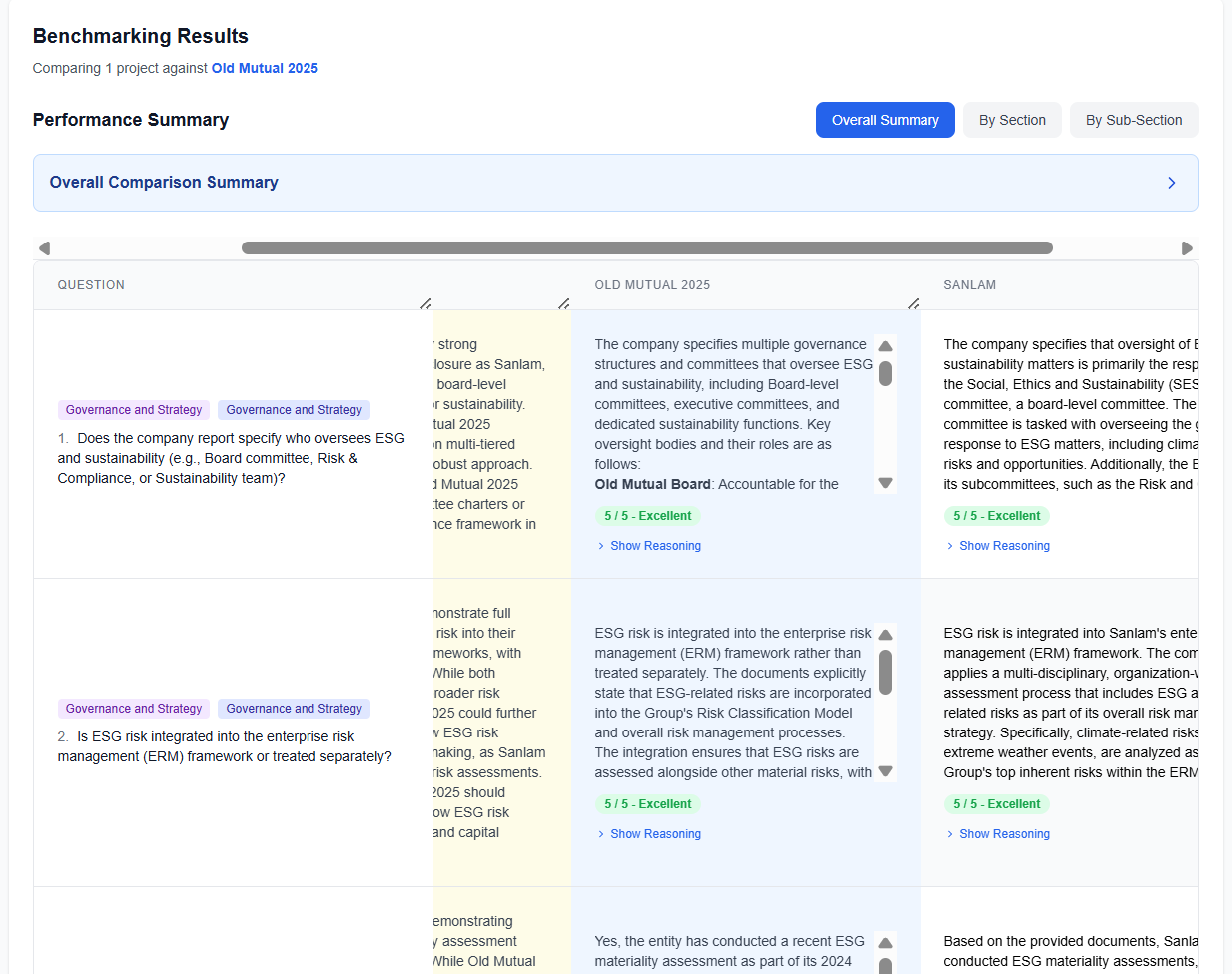

Benchmark against peers with AI scoring

Choose peer organisations and let EASGeniusAI benchmark your ESG disclosures. Identify strengths, gaps and overall AI generated scoring in comparison with your selected peers.

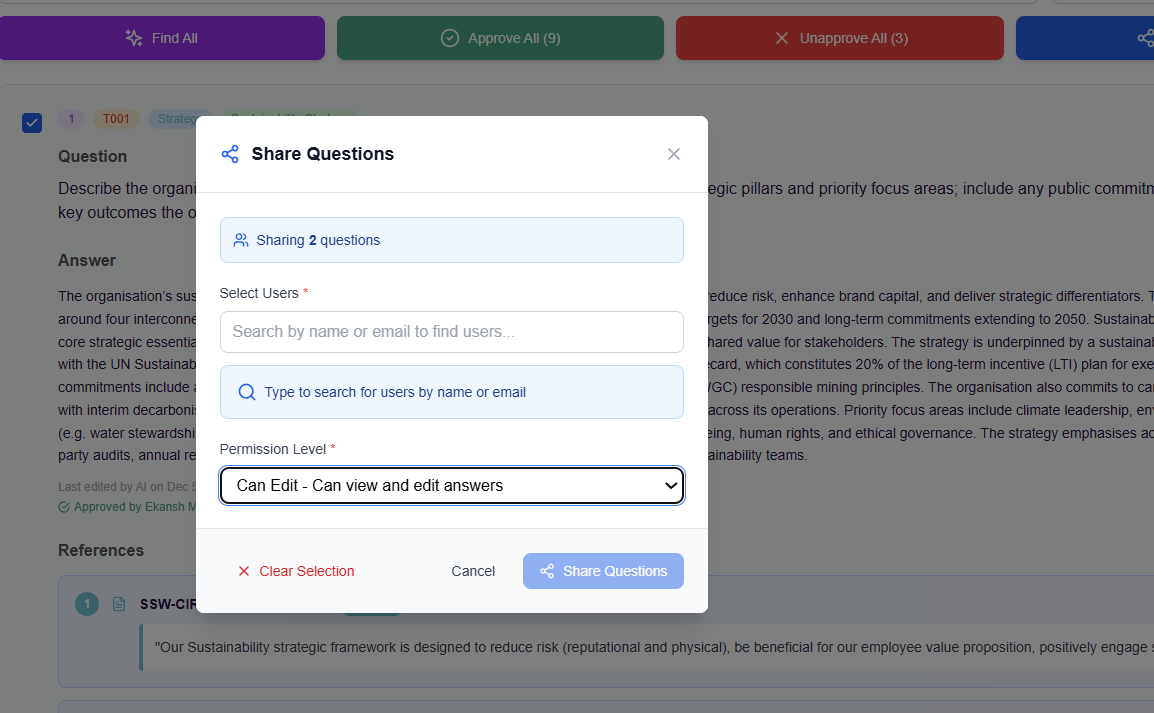

Manage workflow, tasks and collaboration

Give users permissions to edit, view and approve responses based on their roles and responsibilities.

Download reports or

export to CSV

Download completed reports or export structured data to CSV for dashboards, analysis or integration into internal reporting and design tools.

EASGeniusAI: Smarter Management Across the Full ESG Lifecycle

EASGeniusAI drives efficiency across ESG workflows by automating time-intensive analysis, structuring and consolidating ESG intelligence, enabling benchmarking and gap analysis, accelerating drafting and review cycles, and transforming ESG information into strategic insights that support informed decision making, value creation, and long-term business alignment.

Drive efficiency across ESG workflows

Automate time-intensive ESG analysis and assessments, intelligently supplementing and augmenting your team’s capability for interpretation, decision making, and value creation across the full ESG lifecycle.

Save time through structured intelligence

Consolidate ESG information from multiple sources into a consistent format, reducing review and validation workload.

Enable benchmarking and gap analysis

Assess performance against peers, standards, and internal expectations with clearer benchmarking and priority actions.

Accelerate drafting and review cycles

Generate structured, standard aligned responses that support faster internal reviews and smoother approvals.

Generate strategic ESG insights

Transform ESG information into clear, comprehensive, and intelligent insights on strengths, weaknesses, risks, opportunities, and gaps, enabling leadership to make informed decisions and align ESG priorities with business strategy and long term aspirations.

Serving Consulting Firms, Corporates & IR Teams, Asset Managers & Private Equity

Consulting Firms

Support multiple clients efficiently with consistent analysis, benchmarking, and reporting aligned to leading standards, while freeing up time for higher value strategic advisory work.

Corporates & IR

Strengthen disclosures, identify gaps early, and streamline coordination across sustainability, finance, and investor relations teams with clearer structure and traceability.

AM & PE

Assess portfolio performance with consistent scoring, peer comparison, and clear gap analysis to support due diligence, monitoring, and informed engagement.

Get in touch

Do you have questions? We’d love to hear from you.

Email

info@envisionas.com

info@envisionas.com